President Biden today signed into law the Inflation Reduction Act, the largest investment ever made in clean energy in the United States!

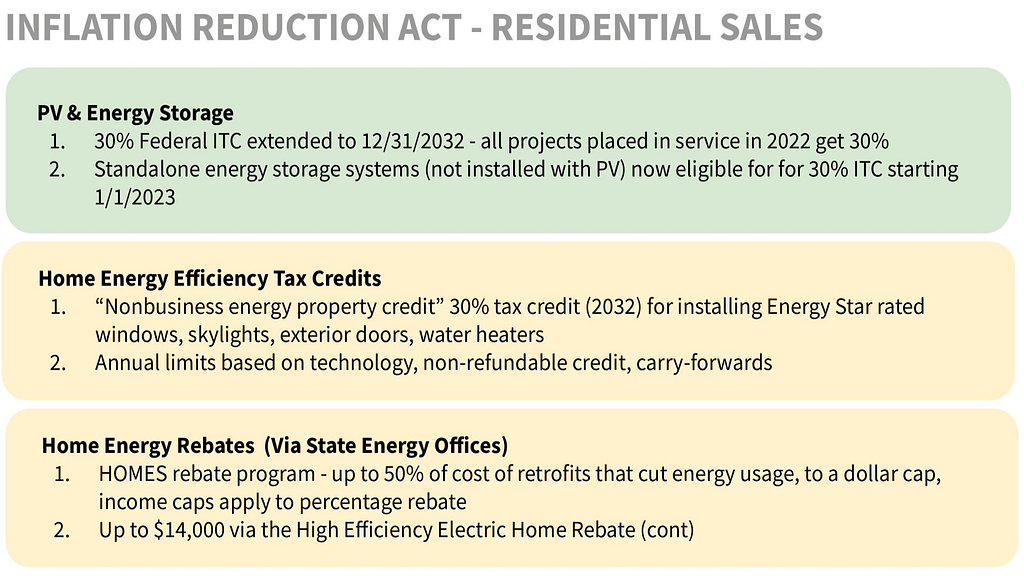

The most important piece of the law for Hawaii customers is the renewal and extension of the 30% Investment Tax Credit, which now replaces the 26% credit for projects installed and operational after 1/1/2022 until 12/31/2032!

That means that any customer that has been installed since 1/1/2022 now qualifies for a 30% federal tax credit instead of the 26% level which was effective until today. This additional value will speed up the return on your solar investment and help you lower home energy costs faster than expected.

The law also contains some other really nice benefits for homeowners, including a 30% tax credit for standalone battery purchases which starts on 1/1/2023.

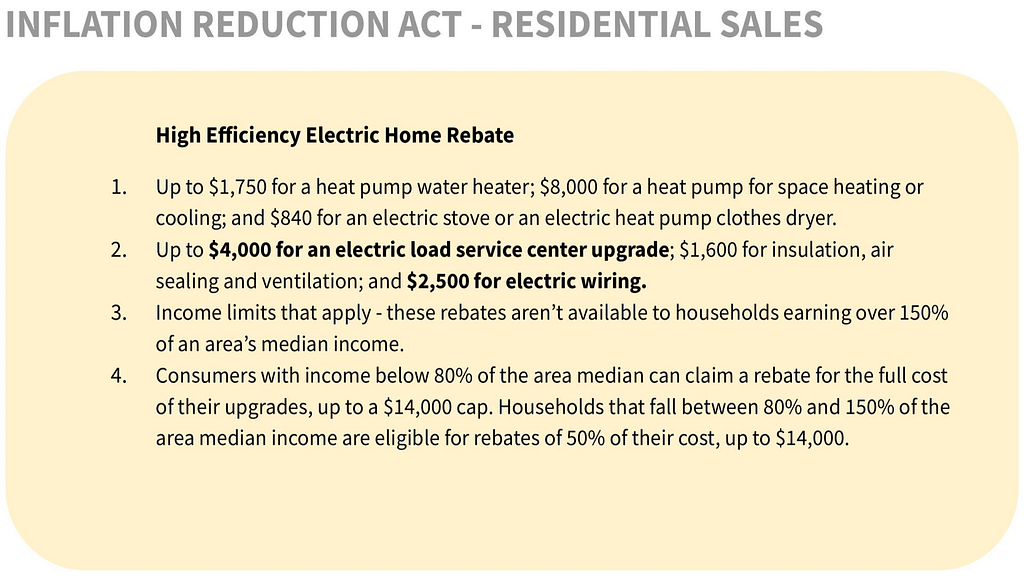

There are also tax credits and rebates for investments in home energy efficiency upgrades and electric vehicles. These benefits are designed to support low and middle-income households that might have been excluded from making these investments in the past.

See all the details on the new Federal Solar Tax Credit